The future of stablecoins and CBDCs: competition or complementarity?

There is little doubt that central bank digital currencies (CBDCs) and stablecoins represent major advancements in the financial technology landscape. As I attended this year’s Money20/20 conference in Amsterdam, both CBDCs and stablecoins generated significant buzz. This should not come as a surprise, given that each successfully addresses a specific set of previously unsolved challenges in the field of digital and cryptocurrency.

While based on different concepts conceived by very different entities, there is also a significant overlap between the types of challenges that CBDCs and stablecoins successfully address, the main being the inherent instability of traditional cryptocurrency. It is no wonder, then, that quite a bit of this buzz at Money 2020 was focused on whether CBDCs and stablecoins will compete or complement each other in the future.

In this article I’ll dive deeper into stablecoins and CBDCs and assess the benefits they’re poised to deliver as well as obstacles to the adoption of each. Ultimately, I'll offer a point of view on whether the future of digital payments has enough room for both, informed by my 30 years of payments industry experience and the broad perspectives I had the opportunity to hear at Money 2020.

Stablecoins and CBDCs defined

Stablecoins are a subcategory of cryptoassets issued by the private sector. They are engineered to mitigate price volatility by pegging their value to a stable asset or a reserve of assets, which could include fiat currencies and commodities. The primary aim of

stablecoins is to address one of the principal concerns associated with cryptocurrencies – their significant price fluctuations.

According to the BIS, at the end of May 2024, the total market capitalisation of cryptoassets amounted to $2.7 trillion. Stablecoins constituted a relatively small proportion (6%) of this market, with a market capitalisation of $161 billion. Even if we take PwC’s more optimistic estimate at face value, stablecoins represent about 10% of the digital assets market – still a long way from ubiquity.

CBDCs are a new form of digital money, denominated in the national unit of account, issued and regulated by the central bank. Preserving the singleness of money is the main reason behind central banks’ pursuit of CBDCs, referring to convertibility at par between different forms of money threatened by the rise of privately issued currency. That said, the other drivers behind CBDCs are truly manyfold, especially as there are actually two different types of CBDCs – retail and wholesale.

Retail CBDCs are intended for consumers and businesses to use in everyday transactions. They differ from existing digital payment instruments that include card payments, credit transfers, direct debits and e-money, as they represent a direct claim on a central bank rather than a liability of a private financial institution.

Wholesale CBDCs are intended for use in transactions between banks, and serve a similar role as settlement balances held at central banks. However, with wholesale CBDCs banks could access new functionalities such as composability (compatibility with other components, tokens, and functions thanks to adherence to the same standards) and programmability (the ability to customize specific features through code or smart contracts), enabled by tokenisation.

Before we assess the possibility of mutual coexistence for CBDCs and stablecoins, it’s important to dive deeper into the benefits each of them bring, but also gain an understanding of the drawbacks to their implementation. This may allow us to understand whether they may in fact complement each other given their respective strengths and weaknesses.

The role of stablecoins and their challenges

Stablecoins have played an important role in the cryptocurrency ecosystem by providing a more stable medium of exchange and store of value. This stability has been essential for the growth of decentralized finance (DeFi), enabling lending, borrowing, and trading without the volatility typically seen in cryptocurrencies like Bitcoin.

Outside of the crypto ecosystem, the use of stablecoins for payments seems to be limited mainly to remittances and retail payments. During 2023, some banks and traditional payment service providers started to use or issue stablecoins to their customers. In April 2023, Société Générale launched the euro-denominated stablecoin EUR CoinVertible to their clients for the settlement of on-chain securities. In August 2023, PayPal launched a USD-based stablecoin (PYUSD) with Paxos. And, in September 2023, Visa announced the expansion of its stablecoin settlement capabilities with USD Coin (USDC) issued by Circle to merchant acquirers. These initiatives show that stablecoins are no longer the exclusive domain of cryptoasset providers and may boost the uptake of stablecoins for payments outside the crypto ecosystem.

However, Stablecoins face several challenges:

- Regulatory scrutiny: Authorities are increasingly concerned about how Stablecoins are backed and managed. Regulatory scrutiny focuses on the potential risks Stablecoins pose to financial stability and consumer protection.

- Reserve transparency: Ensuring stablecoins are fully backed by transparent and reliable reserves is crucial. Lack of transparency can lead to doubts about the stability and solvency of stablecoins, undermining trust.

- Systemic risks: Widespread adoption of stablecoins without proper regulation could pose systemic risks to the financial system. This includes risks related to the concentration of assets, operational failures, and potential runs on Stablecoins during periods of market stress.

Despite these challenges, stablecoins have facilitated significant innovation in the financial sector, particularly in cross-border payments and DeFi applications. Their role in providing a stable and efficient means of transaction has been invaluable, but addressing regulatory and operational challenges is essential for their continued growth and stability.

In this regard, there are some positive regulatory developments which should increase trust, and therefore the future viability of stablecoin globally. These include updates to the accounting standards by the American Institute of Chartered Public Accountants, but also enhanced regulatory coverage in Singapore, the EU, and the UK.

Nevertheless, the risk of fraud and consequent instability in the financial system remains real, which is precisely the strong suit of CBDCs. Alas, CBDCs are not without their own set of challenges.

Download free whitepaper: Capitalizing on the embedded finance revolution

While it simplifies the lives of consumers everywhere, the embedded finance proposition is not a simple one to grasp from an investment perspective. Is embedded finance a fad or a revolution? And how should you approach it - whether you’re an established FI or a fintech looking to make its mark?

Download whitepaperThe role of CBDCs and their challenges

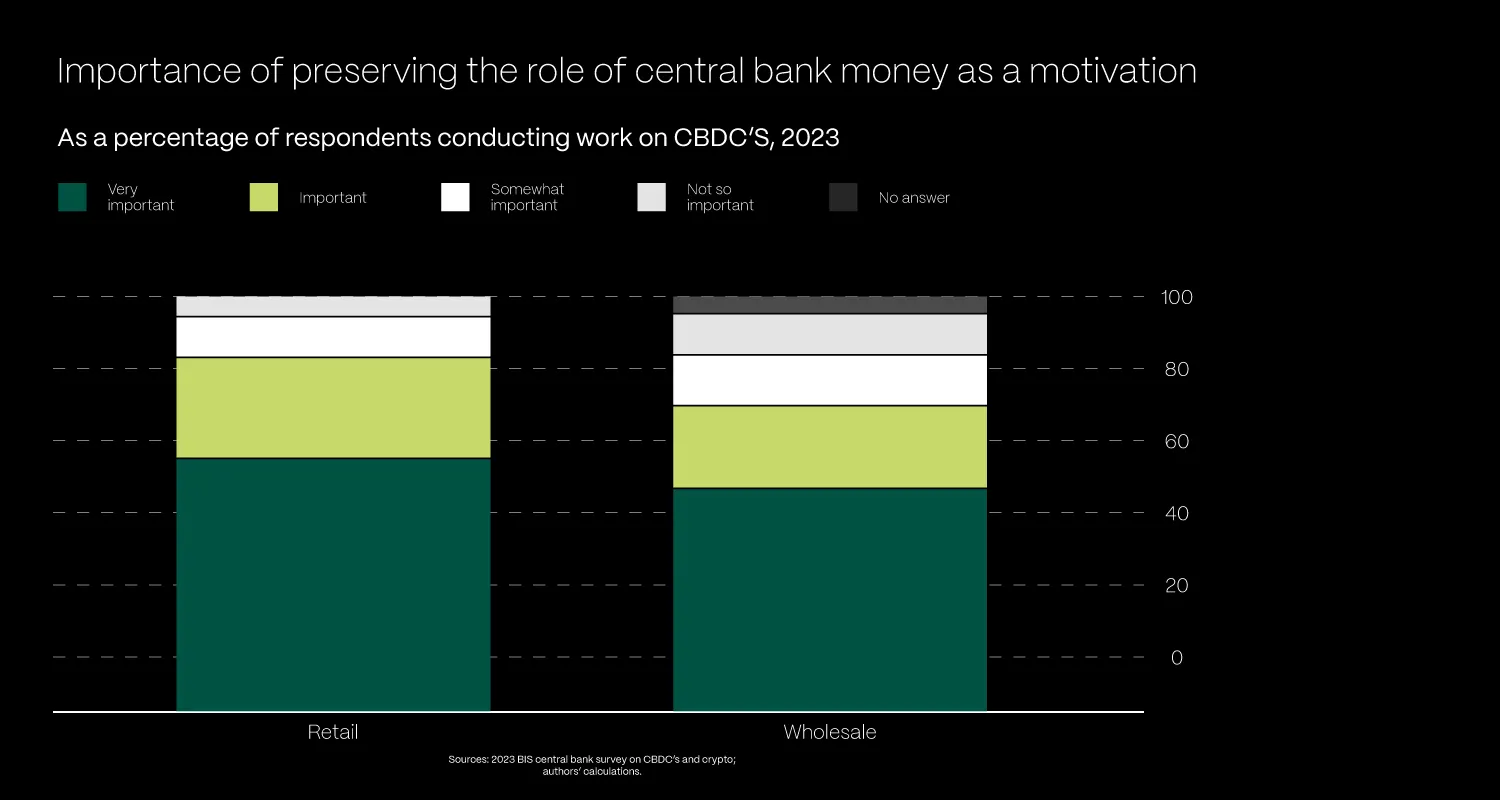

Typical drivers for issuing CBDC as a legal tender include a decline in cash use, financial stability, monetary policy implementation, domestic and cross-border payment efficiency, payment safety, financial inclusion, competition, innovation, and the increase of privately issued digital assets, including stablecoins. That said, the significance of each of the drivers differs when it comes to retail and wholesale CBDCs. In retail CBDCs, the most important driver is the enhancement of domestic payment efficiency, while work on wholesale CBDCs appears to be driven by the desire to enhance cross-border payments per the BIS survey.

According to the same BIS survey, as of late 2023, 94% of 86 surveyed central banks are exploring a CBDC. The central banks are moving forward at their own speed, taking different approaches and considering different design features. In 2023, there has been a significant increase in experiments and pilots with wholesale CBDCs. The likelihood that central banks will issue a wholesale CBDC within the next six years now exceeds the likelihood that they will issue a retail CBDC.

Features-wise, the central banks are increasingly engaging with the stakeholders in order to inform the design of the CBDC. Interoperability and programmability are often considered for wholesale CBDCs. On the retail CBDCs side, more than 50% of central banks are considering holding limits, interoperability, offline options, and zero remuneration. And more importantly, about two out of three responding jurisdictions have or are working on a framework to regulate stablecoins and other cryptoassets. It is also important to note that the majority of central banks are planning to issue a retail CBDC working with commercial banks and payments firms, rather than distributing CBDCs directly to consumers.

Central banks want to see the justification for implementing the CBDC rather than rush into it just because there is a technical solution that works. The concerns with regards to CBDCs are many and include risks to:

- Financial privacy and financial freedom with many citizens being uncomfortable with what they perceive as unnecessary intrusion from the central government into their lives. Different parts of the world have different levels of tolerance to such perceived intrusions, but this concern would be a particular barrier in the US.

- Stability of the private sector banking system and credit creation, as the implementation of CBDCs may face particular resistance from established FIs as well, who will certainly not take kindly to such potential disruption of their business models.

- Successful implementation given the cost as well as the lack of tangible consumer benefits and, as a result, low adoption in the already live jurisdictions.

On the other hand, we have increasingly digital economies, decline in the use of central bank’s cash, and new digital money use cases emerging. Understanding that the design, testing, piloting and the legislative, regulatory and technological changes will take a few years to develop, most central banks continue to push forward thus acknowledging that in the future a CBDC is likely to be required. At this point, given the stated positions of various central banks, it is more likely that we will see a wholesale CBDC over the next six years, than a retail one.

Future insights from Money 2020: Competition or complementarity?

The world is rarely black and white, and so it is the case with the future competition and/or complementarity between CBDCs and stablecoins. Understanding how these two types of digital currencies interact will be crucial for shaping the future of finance. Here are the two polar opposite views, with the future being likely somewhere in between the two:

- Competition: CBDCs could compete with stablecoins in areas such as everyday transactions and savings. State-backed CBDCs may offer greater trust and stability, potentially becoming the preferred choice for consumers and businesses seeking a reliable digital currency.

- Complementarity: There is significant potential for CBDCs and stablecoins to complement each other. CBDCs can provide a secure and regulated framework for digital transactions, while Stablecoins can offer innovative solutions in areas like cross-border payments and DeFi. The flexibility and adaptability of stablecoins could enhance the functionality and reach of CBDCs, creating a more robust and versatile financial ecosystem.

Discussions at Money2020 in Amsterdam underscored the dynamic and evolving nature of digital currencies. Key insights from the event highlighted the necessity for a balanced regulatory environment that fosters innovation while ensuring stability and security. Collaborative efforts between public and private sectors are essential to harness the full potential of digital currencies, which is encouraging for both the future of CBDCs and stablecoins.

Therefore, the future of digital currencies is poised to be shaped by the interplay between CBDCs and stablecoins. While they may compete in certain areas at first, thus defining their specific long-term habitats in the financial ecosystem, their complementarity offers significant potential for enhancing the global financial system. By addressing the challenges and leveraging the strengths of both CBDCs and stablecoins, we can create a more efficient, secure, and inclusive financial ecosystem. Insights from events like Money2020 will continue to play a crucial role in navigating this evolving landscape, ensuring that innovation and regulation go hand in hand to build a sustainable digital currency future.

All of this leads me to believe that CBDCs and stablecoins will complement rather than compete with each other. CBDCs can provide a secure and regulated backbone for digital transactions, while stablecoins can drive innovation and flexibility, particularly in cross-border payments and DeFi. Together, they can create a more resilient, efficient, and inclusive financial landscape. This complementary relationship will harness the strengths of both digital currencies, ensuring a stable yet dynamic financial future.

The synergy between CBDCs and stablecoins is not only possible but essential for the evolution of the global financial system.