Custom FinTech software development

Powered by AI, cutting-edge FinTech solutions continue to evolve. The goal? Adapting to users’ growing needs. They provide much-needed insights into customers’ spending patterns and behaviors. The result? FinTech players can better understand their clients and tailor their services to the requirements of a competitive market.

That is why developing a one-size-fits-all FintTech solution is not possible. At Vega IT, we’re at our best when delivering custom-made FinTech solutions. Finding better ways to solve problems. Making products that generate lasting value. We’re thinking beyond the boundaries of ordinary requirements. We understand the challenges you’re facing.

IPR deadlines are here: How banks and fintechs can adap...

The European Union’s Instant Payments Regulation (IPR) is poised to transform the payments landscape by making instant payments the new norm for euro-denominated transactions. This initiative aims to foster financial inclus...

Expert FinTech software development company

You’ve got a big idea. We’re here to help you turn it into reality. Whether you need to expand your in-house capability or spin up a whole development team, we adapt to your needs. Seasoned developers. Business analysts. Data engineers. Product owners. Whether you are a financial institution or a FinTech company, we’re the firepower you need.

The FinTech software solutions we can help you with

FinTech and financial services companies aim to offer innovative solutions to address clients' growing needs. Vega IT is there to support them as a technical partner. We’ve worked on a variety of FinTech projects across Europe. Many of our clients have been working with us for years. It means we’ve built up a huge amount of expertise across the tightly regulated FinTech sector. Here is what we can help you with:

Embedded finance

Financial products integrated into a broader customer journey. That is what embedded finance is about. It has been around for quite a long time in the offline world. Sales financing at furniture and home appliance stores. Private-label credit cards offered by major retailers. Those are just some examples of embedded finance. That is one of the fastest-growing financial services. As such, it requires continuous innovation. Teamed with banks and technology providers, software companies are now creating convenient and seamless digital solutions.

Digital banking

Reliable. Secure. Fast. Efficient. User-friendly. Those are the requirements for digital banking – one of the most popular FinTech solutions.

Mobile payments and wallets

Transferring money between accounts. Completing purchases. Paying bills without going to the bank. All of this without having to go to the bank.

Mobile payments and wallet transactions provide the utmost convenience. Setting rules against specific spending categories. Limiting the amount of money spent. Customers can manage finances without a hitch.

Payment processing software

Payment technology (PayTech) includes different types of digital payment solutions. Services such as PayPal, Venmo, Google Pay, and Apple Pay have a global impact on customers' lives. PayTech is easy to use, safe, and available 24/7.

Core banking software

Core banking systems cover different aspects of daily banking operations. Processing daily banking transactions. Loan and credit processing. Updating account information and reporting. Those are just some of its numerous applications.

Blockchain, cryptocurrencies, and CBDC

This is one of the most trending branches of the FinTech ecosystem. Blockchain engineers design, build, and maintain decentralized blockchain applications. Some examples are cryptocurrency exchanges, lending applications, and domestic and cross-border payment solutions.

In addition to private cryptocurrencies, the early-stage development of central-bank digital currencies (CBDCs) is taking place around the globe. It is expected to enable new use cases and be a much-needed value anchor for web3 applications.

What we have done for our customers

Over 1000 successfully delivered projects across Europe, the US, and the UAE. The world's most innovative businesses choosing to work with us for years. We turn your vision into reality.

Our workWe’re here to find fast, elegant solutions to your trickiest problems.

Get in touch

Whitepaper

Capitalizing on the embedded finance revolution

Download the free whitepaper

Is embedded finance a fad or a revolution? And how should you approach it - whether you’re an established FI or a fintech looking to make its mark? Download the free whitepaper and learn what you must keep in mind as you enter the embedded finance market.

What else can we do for you?

Strength in numbers

Which business model suits you?

Different budgets, deadlines, challenges, and requirements. There is no one-size-fits-all approach to software development. To match your exact goals and ambitions, we offer two types of business models:

- Time & material: Greater control. Flexibility. Participation in candidate selection. With no rigid processes or end dates, this business model is easier to scale up or down as your business needs change.

- Fixed price: Fixed scope. Fixed budget. Fixed timeline. Those are the main benefits of the fixed price model. You set the requirements upfront, and we deliver the project within them.

Many clients choose to start with the fixed-price model. However, as their project scope evolves, they typically shift to the time & material model.

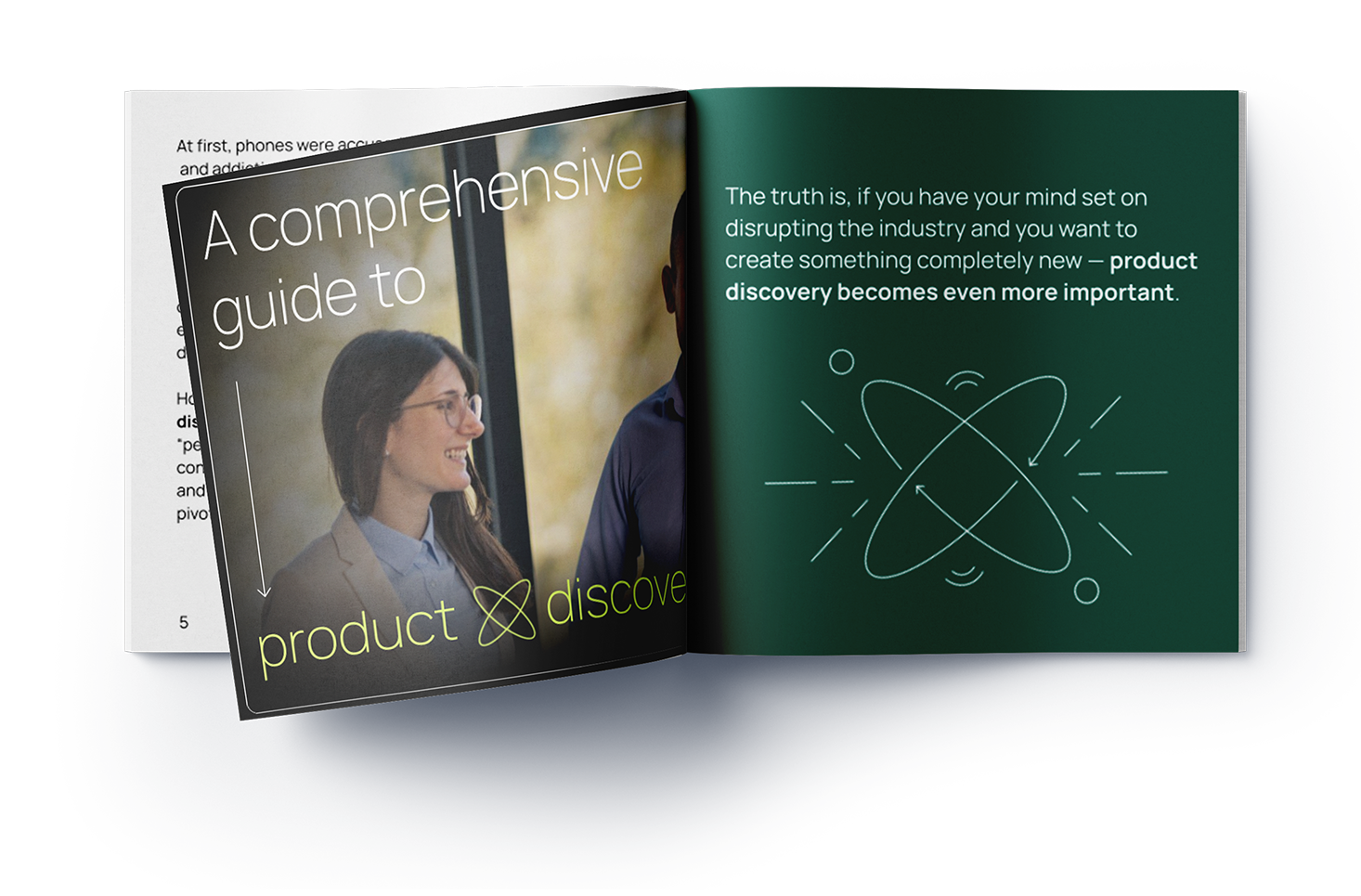

A comprehensive guide to product discovery

How to prevent huge financial losses when building your product?

It’s all because of the sound and proven discovery process. Whether you’re exploring a third-party solution or want to build something from scratch, validation is incredibly important.

Download the free guide

Avoid common pitfalls in validating your product ideas. Whether you’re an aspiring entrepreneur, an early-stage startup, or an investor–you’re not immune to making mistakes, which is why it’s useful to acknowledge them in advance. Download the guide and learn more on how to validate your product ideas

And we’ve won some big awards for our work

Sasa co-founded Vega IT 17+ years ago with his former university roommate Vladan. Their dream of founding an IT company has grown into the premier software company with more than 900+ engineers globally. If you prefer to send an email, feel free to reach out at hello.sasa@vegaitglobal.com.

Real people. Real pros.

Book a call today.Send us your contact details and a brief outline of what you might need, and we’ll be in touch within 12 hours.